- The Investing Authority

- Posts

- 📊Most Important Week of the Summer

📊Most Important Week of the Summer

Issue #63 TIA Market Recap

Hey there!

Welcome to The Investing Authority Newsletter.

Join our savvy investors sharing weekly market forecasts and recaps, delivered straight to your inbox. If you want to stay ahead of the trends be sure to subscribe now and be part of the action!

The Investing Authority specializes in helping companies enhance their visibility within the investment community through marketing, advisory, and partnership services. See more Here.

This Week’s Market Forecast… 📊

The most important week of the summer has arrived. Stocks are pushing higher, with the S&P and Nasdaq printing fresh highs following a strong V-shaped recovery off the April tariff scare. But this week brings a storm of catalysts that could determine whether the rally has legs or if a pullback is brewing.

The Fed is front and center. The two-day FOMC meeting wraps on Wednesday, and while no cut is expected, traders will be locked in on Powell’s tone and guidance. A September pivot is on the table if inflation cooperates. This week’s PCE report will be critical in shaping that view. A cooler number gives the green light for easing. A hotter print could delay cuts and pressure risk assets.

Friday brings the July jobs report, with economists expecting a gain of around 102,000 jobs. A soft report may reinforce the disinflation narrative and support equities, but a strong print could reignite concerns that the Fed will need to stay restrictive for longer. The labor market has cooled but not cracked, which is exactly the balancing act the Fed is trying to maintain.

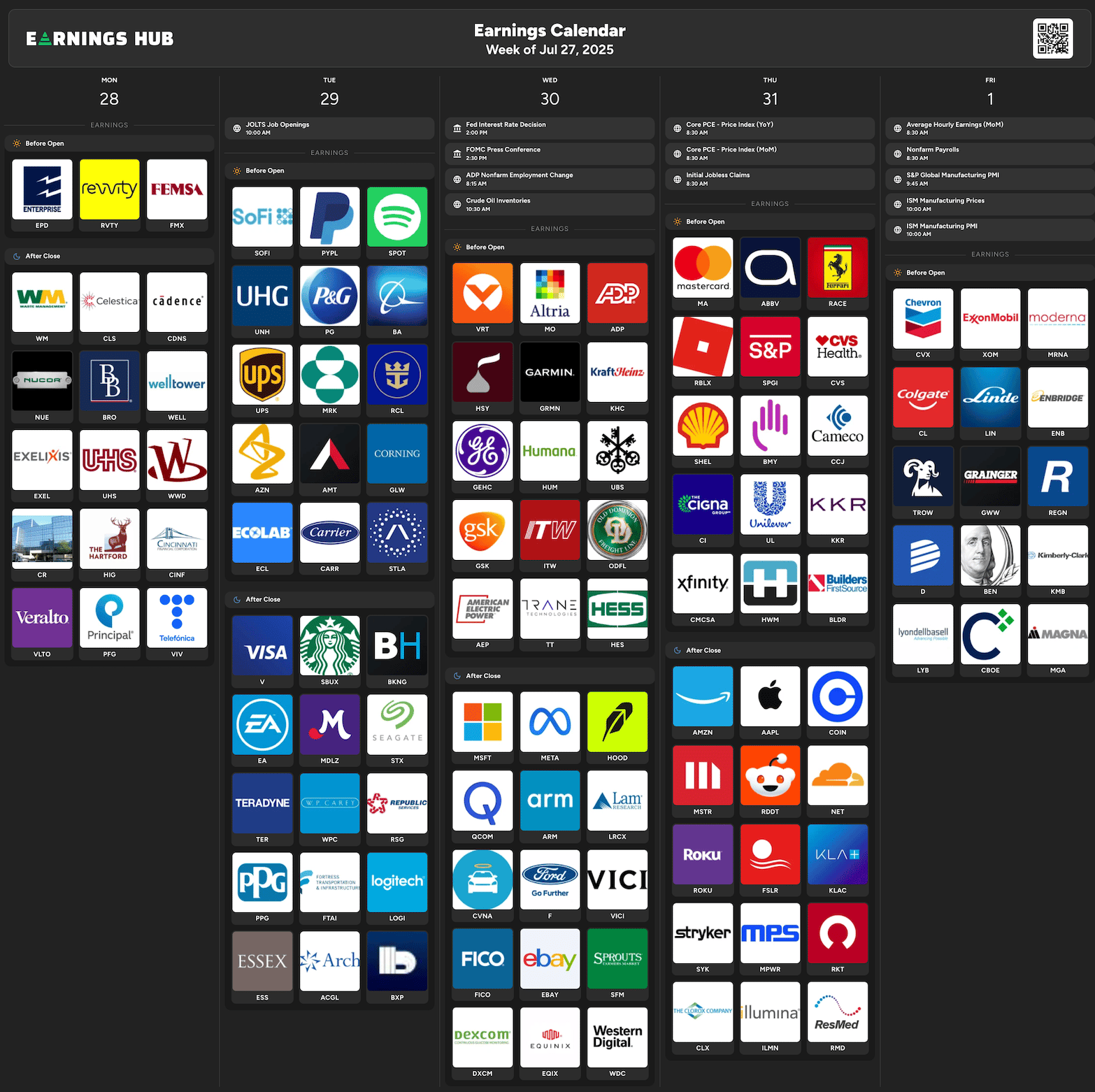

Earnings remain a major driver, with over 160 S&P names reporting this week, including Apple, Microsoft, Amazon, and Meta. Big tech has carried the market this year, so investors will be hyper-focused on forward guidance, AI spend, and margins. The market needs these names to deliver. If they stumble, we could see rotation or consolidation even if the broader economy holds up.

This is a make-or-break week. Between the Fed, jobs data, tech earnings, and trade headlines, investors are about to get a flood of information that will define the tone for the rest of Q3. If the data lands right and earnings deliver, the rally has room to run. If not, get ready for some chop.

Have a wonderful week!!

Top ETFs on our Radar… 📈

iShares Expanded Tech-Software Sector ETF

The iShares Expanded Tech-Software Sector ETF has performed exceptionally well this year. Software companies have shown strong performance as investors seek to identify the next big winner in AI.

Tune in every Monday and Friday for in-depth Market Analysis, Recaps, and a featured Stock & ETF.

Thanks for reading and have a great week!

-Ryan

|