- The Investing Authority

- Posts

- 📊Earnings Season Begins with Major Banks Beating Expectations

📊Earnings Season Begins with Major Banks Beating Expectations

Issue #61 TIA Market Recap

Hey there!

Welcome to The Investing Authority Newsletter.

Join our savvy investors sharing weekly market forecasts and recaps, delivered straight to your inbox. If you want to stay ahead of the trends be sure to subscribe now and be part of the action!

The Investing Authority specializes in helping companies enhance their visibility within the investment community through marketing, advisory, and partnership services. See more Here.

This Week’s Market Forecast… 📊

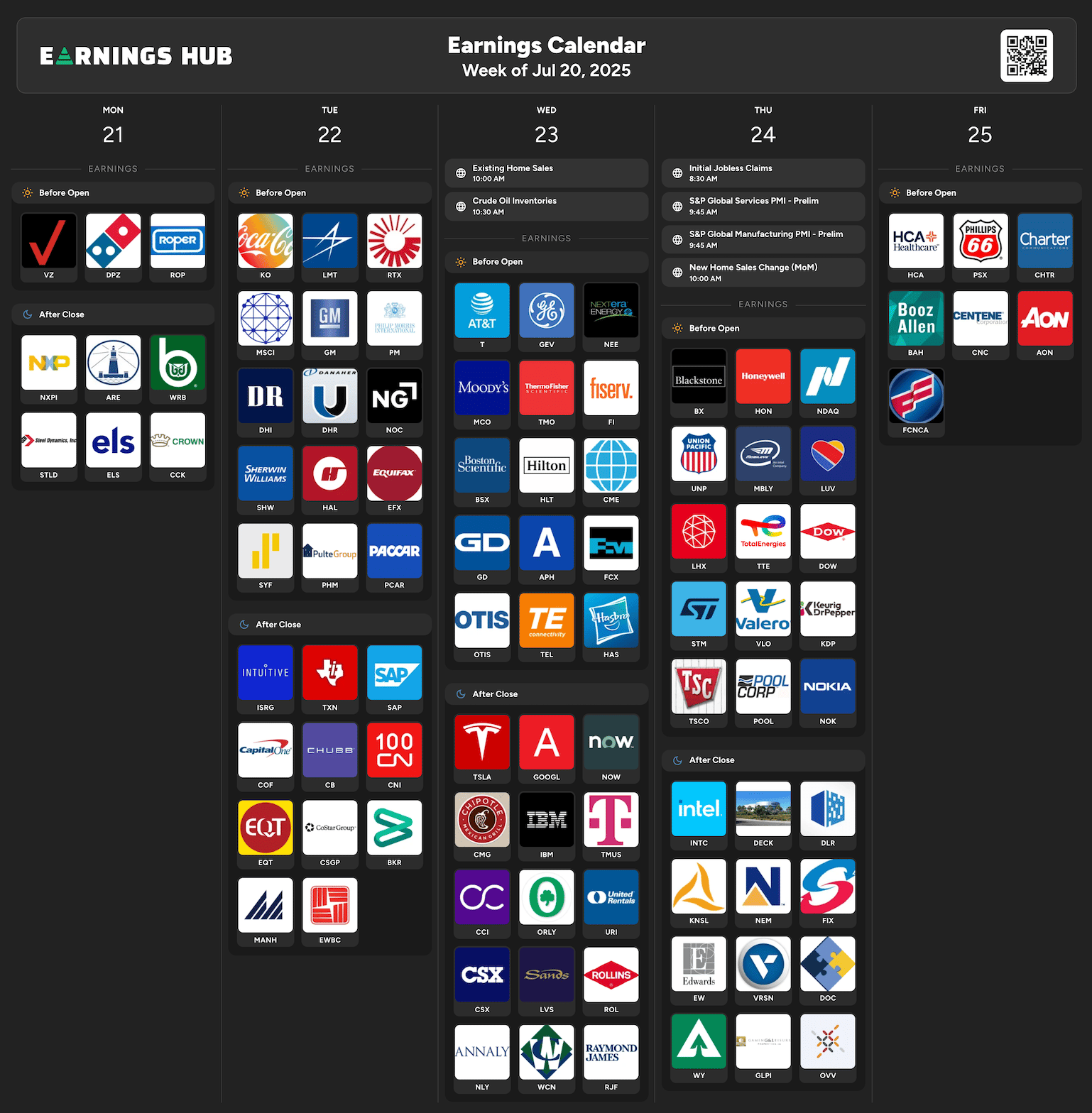

Stocks continue to hover near all-time highs, but this week could be a turning point. Earnings are coming in stronger than expected, with S&P 500 companies tracking over 9 percent year-over-year growth. Big banks like JPMorgan and Goldman Sachs have already reported solid results, showing strength in consumer credit and investment banking. Now the spotlight turns to tech. With Alphabet and Tesla reporting this week, investors will be watching closely for any surprises that could steer the next leg of the market.

Trade tensions are creeping back into focus as the August 1 tariff deadline approaches. While markets have largely brushed off the threat, memories of April’s tariff-driven pullback linger. Deutsche Bank recently warned that tariff-related inflation risks remain under-appreciated, and any shift in policy tone could impact both growth expectations and Fed strategy. Fed Chair Powell has also come under increasing political pressure, with public criticism from President Trump, raising questions about the central bank’s independence. Despite that, Fed officials like John Williams have reiterated that current policy is appropriate and that new tariffs could complicate progress on inflation.

Investor sentiment is rising alongside the market. Bank of America reports that cash levels have dropped below 4 percent, and risk appetite is now the highest since February. Investors aren’t pulling back — they’re rotating, moving into cyclicals and high-beta names. While this shows growing confidence in the economy, it also reflects a more crowded market, where negative surprises could carry more weight. At the same time, market breadth remains limited. Small caps and cyclicals are still lagging behind mega-cap tech, raising questions about how sustainable this rally really is.

Bottom line this is a pivotal week, and the setup is promising. With banks out of the way and tech earnings taking over, the market has a chance to build on its momentum. Tariff headlines and Fed speculation are real risks, but so far, investors have looked through them. If Big Tech delivers and economic data stays stable, we could see this rally broaden out and reach higher highs. This is a moment to stay focused, lean into quality, and take advantage of strength.

Have a wonderful week!!

Top ETFs on our Radar… 📈

iShares Expanded Tech-Software Sector ETF

The iShares Expanded Tech-Software Sector ETF has performed exceptionally well this year. Software companies have shown strong performance as investors seek to identify the next big winner in AI.

Tune in every Monday and Friday for in-depth Market Analysis, Recaps, and a featured Stock & ETF.

Thanks for reading and have a great week!

-Ryan

|