- The Investing Authority

- Posts

- 📊High-Stakes Week: Earnings, the Fed, and Economic Insights

📊High-Stakes Week: Earnings, the Fed, and Economic Insights

Issue #28 TIA Market Recap

Hey there!

Welcome to The Investing Authority Newsletter.

Join our savvy investors sharing weekly market forecasts and recaps, delivered straight to your inbox. If you want to stay ahead of the trends be sure to subscribe now and be part of the action!

The Investing Authority specializes in helping companies enhance their visibility within the investment community through marketing, advisory, and partnership services. See more Here.

This Week’s Market Forecast… 📊

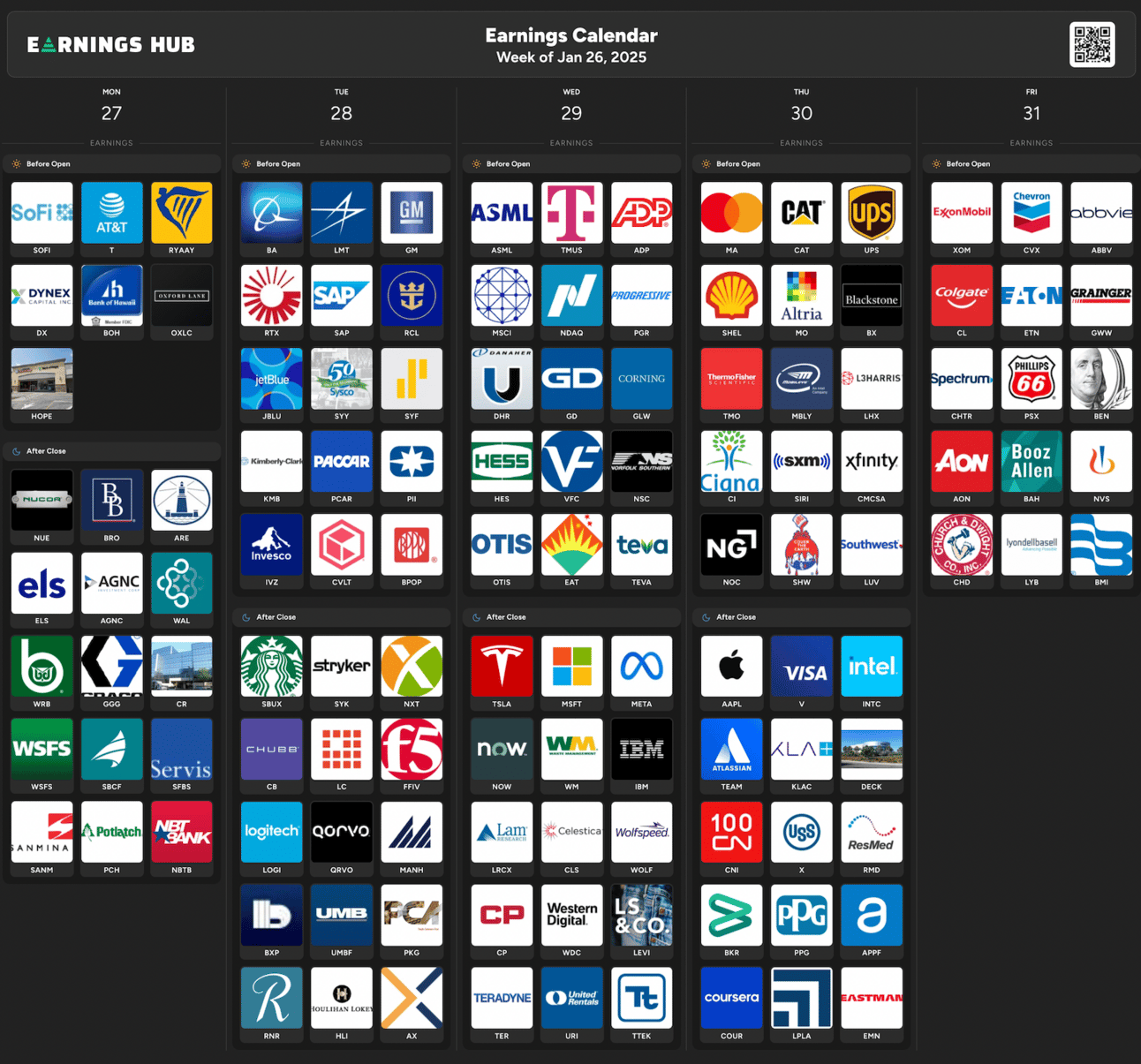

This will be the most influential week of the year so far. We have earnings from almost all of the magnificent 7 companies and a Federal Reserve Meeting. Wednesday will specifically be busy with Fed Chairman Powell’s press conference at 2:30 PM EST and Tesla, Microsoft, and Meta reporting after the bell.

With these major tech firms reporting, we'll gain valuable insights into the state of the economy. It seems that every earnings season culminates in a pivotal week like this, where all the major tech players report.

The market has rallied over the past two weeks, driven by a strong earnings season. Banks kicked off the season two weeks ago, highlighting a resilient consumer. Last week, bullish sentiment persisted, pushing the S&P 500 to its first all-time high of the year.

This week also brings key economic data after a relatively quiet period. On Thursday, the GDP report will provide an update on U.S. economic growth, followed by the PCE report on Friday— the Fed’s preferred measure of inflation.

As I write this on Sunday night, the market is down over one percent in pre-market trading. Over the weekend, China announced a new AI model named DeepSuck, which is expected to compete with ChatGPT. Concerns over this potential competitor have weighed on the market, with the Nasdaq down 1.6% and NVIDIA down 5%.

In my view, this reaction to a new market entrant is an overreaction. Any pullback stemming from this news could present a buying opportunity for investors.

As always, be positive, get invested, and stay optimistic.

Have a wonderful week!!

Top ETFs on our Radar… 📈

The Vanguard Total Stock Market ETF (VTI) is an exchange-traded fund that aims to track the performance of the entire U.S. stock market, covering large-, mid-, small-, and micro-cap stocks. It seeks to replicate the CRSP US Total Market Index and provides broad diversification with exposure to over 3,500 stocks across various sectors. VTI is known for its low expense ratio and long-term growth potential.

Tune in every Monday and Friday for in-depth Market Analysis, Recaps, and a featured Stock & ETF.

Thanks for reading and have a great week!

-Ryan

|