- The Investing Authority

- Posts

- 📊All Eyes on the Banks

📊All Eyes on the Banks

Issue #60 TIA Market Recap

Hey there!

Welcome to The Investing Authority Newsletter.

Join our savvy investors sharing weekly market forecasts and recaps, delivered straight to your inbox. If you want to stay ahead of the trends be sure to subscribe now and be part of the action!

The Investing Authority specializes in helping companies enhance their visibility within the investment community through marketing, advisory, and partnership services. See more Here.

This Week’s Market Forecast… 📊

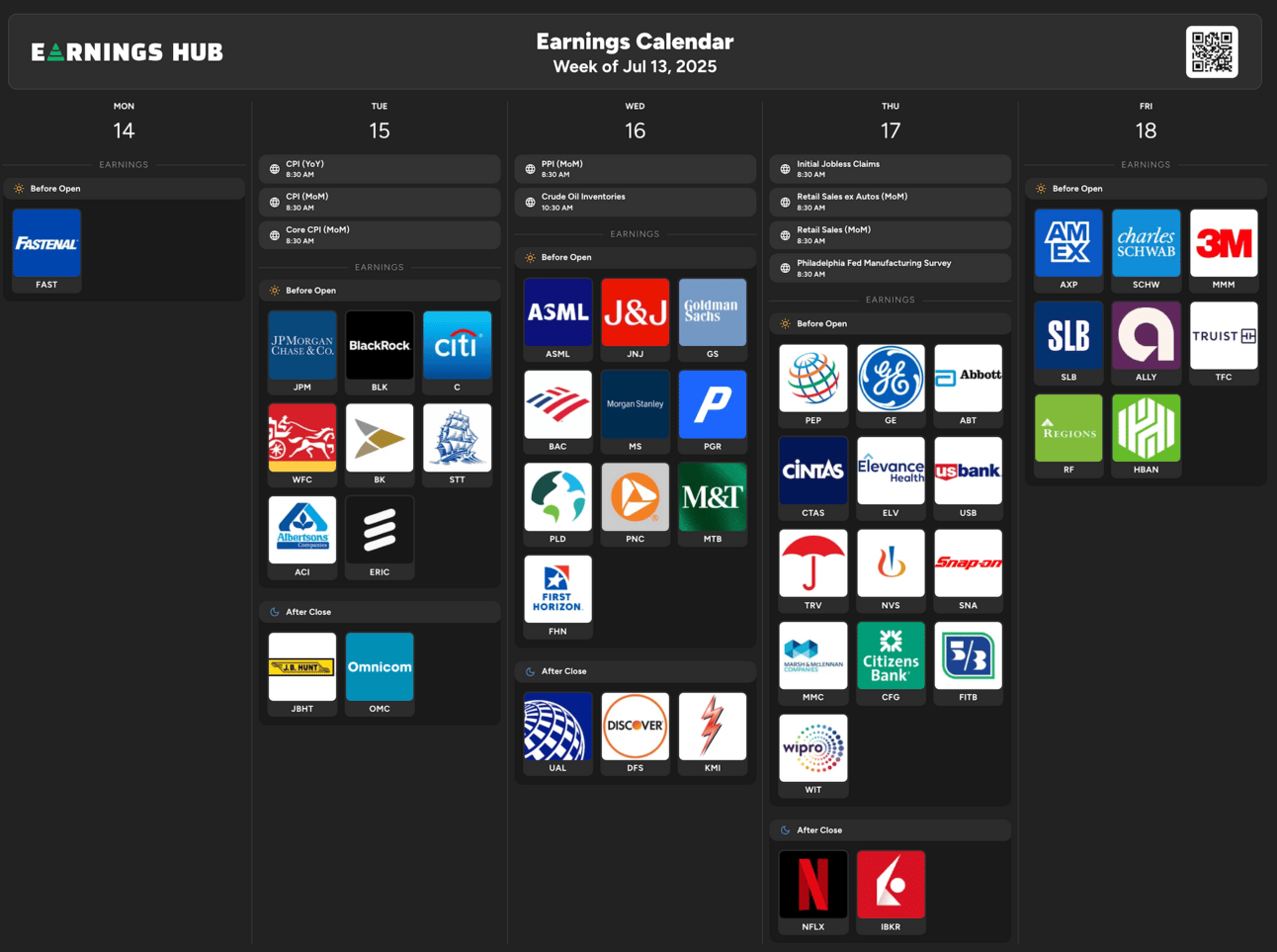

The Q2 earnings slate starts with major financials. JPMorgan, Citigroup, and Morgan Stanley will offer a read on the economy, consumer behavior, and deal activity. Early reports will shape sentiment fast. Analysts expect roughly 4 percent year-over-year S&P 500 earnings growth, but recent revisions have trended lower. The bar is set. Now it’s time to see who clears it.

Trade risk is returning. The United States has delayed but not canceled a major round of tariffs that was initially scheduled for July 1. The new target date is August 1. This week, markets will be sensitive to any updates or escalation. Expect headlines to move sectors like semiconductors, industrials, and consumer discretionary.

AI momentum remains a dominant theme. Nvidia continues to outperform the market and is now up 44 percent since April. Investors are still piling into the AI trade. With tech earnings just around the corner, this trend could accelerate or cool off depending on the results. Keep an eye on semiconductors, software, and chip infrastructure.

There is no rate move expected this month, but the Federal Reserve’s path remains a key variable. Current expectations are for two rate cuts in 2025, down from three just a few months ago. Strong earnings or hotter inflation data could shift that outlook. The Fed may be sidelined for now, but they are still influencing the playbook.

The S&P 500 and Nasdaq are trading near all-time highs. Under the surface, however, leadership is narrow and driven by a handful of mega-cap names. This kind of concentration is historically fragile. Long-term investors should stay selective and prioritize companies with strong balance sheets, pricing power, and consistent earnings growth.

Have a wonderful week!!

Top ETFs on our Radar… 📈

iShares Expanded Tech-Software Sector ETF

The iShares Expanded Tech-Software Sector ETF has performed exceptionally well this year. Software companies have shown strong performance as investors seek to identify the next big winner in AI.

Tune in every Monday and Friday for in-depth Market Analysis, Recaps, and a featured Stock & ETF.

Thanks for reading and have a great week!

-Ryan

|